Energy Shift

Who’s Still Buying Russian Fossil Fuels in 2023?

The Countries Buying Fossil Fuels from Russia in 2023

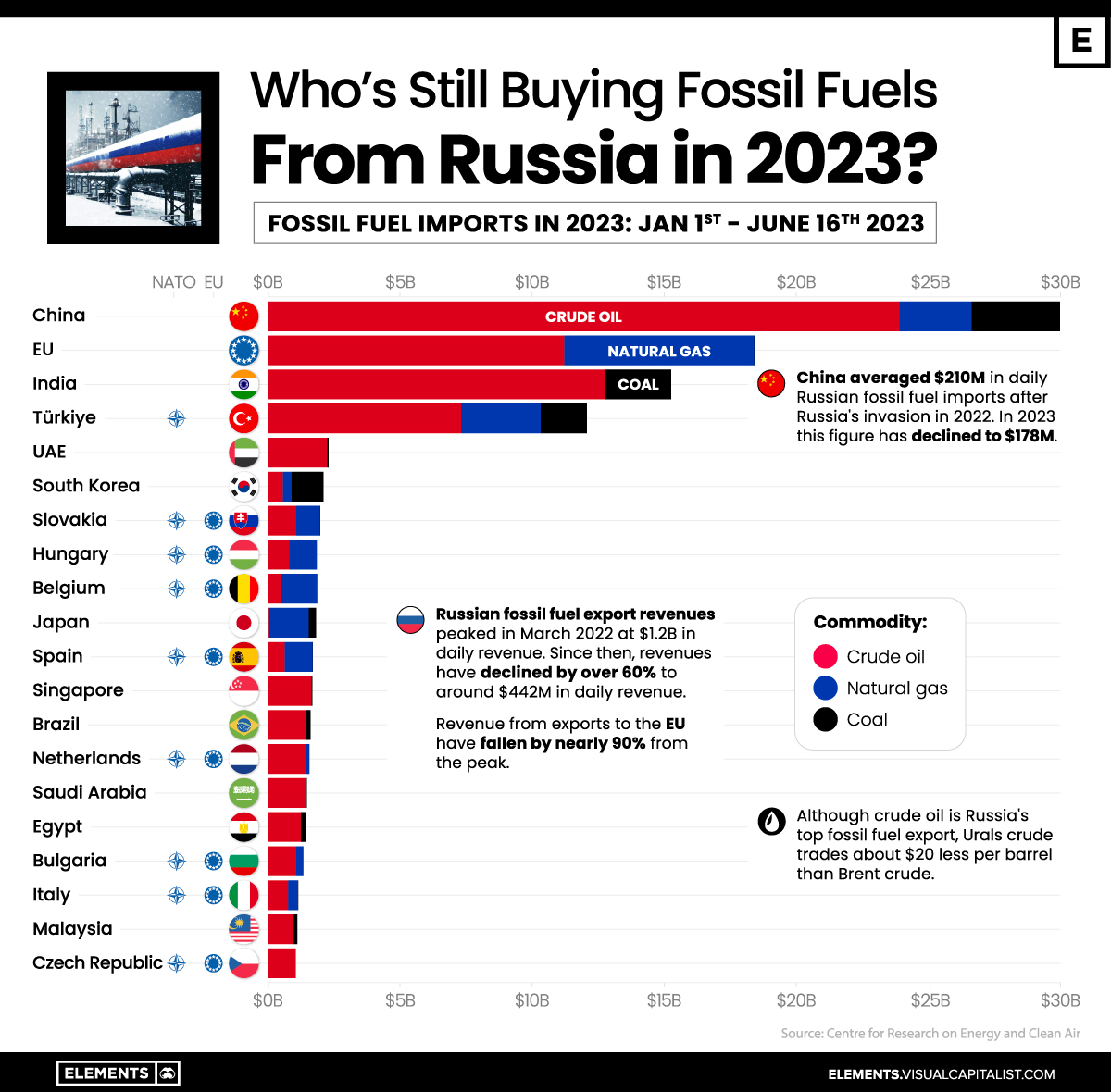

While Russia’s revenues from fossil fuel exports have declined significantly since their peak in March of 2022, many countries are still importing millions of dollars a day worth of fossil fuels from Russia.

Revenue from fossil fuels exported to the EU has declined more than 90% from their peak, but in 2023 the bloc has still imported more than $18 billion of crude oil and natural gas so far.

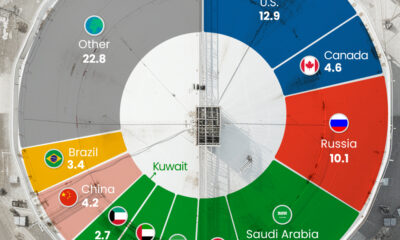

This graphic uses data from the Centre for Research on Energy and Clean Air (CREA) to visualize the top-importing countries of fossil fuels from Russia so far this year.

China Remains Russia’s Top Fossil Fuel Importer

China continues to be Russia’s top buyer of fossil fuels, with imports reaching $30 billion in 2023 up until June 16, 2023.

With nearly 80% of China’s fuel imports being crude oil, Russia’s average daily revenues from Chinese fossil fuel imports have declined from $210 million in 2022 to $178 million in 2023 largely due to the falling price of Russian crude oil.

Following China are EU nations collectively, which despite no longer importing coal from Russia since August of 2022, still imported $18.4 billion of fossil fuels in a 60/40 split of crude oil and natural gas respectively.

| Country | Russian Fossil Fuel Imports* (Total) | Crude Oil | Natural Gas | Coal | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 🇨🇳 China | $30.0B | $23.9B | $2.7B | $3.3B | |||||||||

| 🇪🇺 EU | $18.4B | $11.2B | $7.2B | $0 | |||||||||

| 🇮🇳 India | $15.2B | $12.8B | $0 | $2.5B | |||||||||

| 🇹🇷 Türkiye | $12.1B | $7.3B | $3B | $1.7B | |||||||||

| 🇦🇪 UAE | $2.3B | $2.3B | $0 | $0 | |||||||||

| 🇰🇷 South Korea | $2.1B | $0.6B | $0.3B | $1.2B | |||||||||

| 🇸🇰 Slovakia | $2.0B | $1.1B | $0.9B | $0 | |||||||||

| 🇭🇺 Hungary | $1.9B | $0.8B | $1.1B | $0 | |||||||||

| 🇧🇪 Belgium | $1.9B | $0.5B | $1.4B | $0 | |||||||||

| 🇯🇵 Japan | $1.8B | $0 | $1.5B | $0.3B | |||||||||

| 🇪🇸 Spain | $1.7B | $0.6B | $1.1B | $0 | |||||||||

| 🇸🇬 Singapore | $1.7B | $1.7B | $0 | $0 | |||||||||

| 🇧🇷 Brazil | $1.6B | $1.4B | $0 | $0.2B | |||||||||

| 🇳🇱 Netherlands | $1.6B | $1.5B | $0.1B | $0 | |||||||||

| 🇸🇦 Saudi Arabia | $1.5B | $1.4B | $0 | $0 | |||||||||

| 🇪🇬 Egypt | $1.4B | $1.3B | $0 | $0.2B | |||||||||

| 🇧🇬 Bulgaria | $1.3B | $1.1B | $0.3B | $0 | |||||||||

| 🇮🇹 Italy | $1.2B | $0.8B | $0.4B | $0 | |||||||||

| 🇲🇾 Malaysia | $1.1B | $1.0B | $0 | $0.1B | |||||||||

| 🇨🇿 Czech Republic | $1.0B | $1.1B | $0 | $0 |

*Over the time period of Jan 1, 2023 to June 16, 2023 in U.S. dollars

After China and the EU bloc, India is the next-largest importer of Russian fossil fuels, having ramped up the amount of fossil fuels imported by more than 10x since before Russia’s invasion of Ukraine, largely due to discounted Russian oil.

Türkiye is the only other nation to have imported more than $10 billion worth of Russian fossil fuels in 2023, with every other country having imported fewer than $3 billion worth of fuels from Russia this year.

Navigating the Crude Reality of Oil Exports

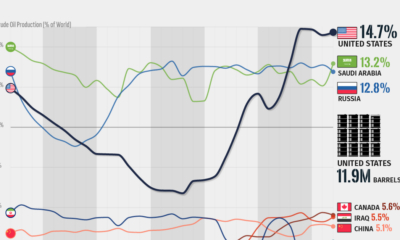

Although crude oil is Russia’s chief fossil fuel export, the nation’s Urals crude traded at a $20 per barrel discount to Brent crude throughout most of 2023. While this discount has narrowed to around $16 following Russia’s announcement of further oil export cuts of 500,000 bpd (barrels per day), the price of Urals crude oil remains just 40 cents below the $60 price cap put in place by G7 and EU nations.

Alongside Russia, Saudi Arabia also announced it would extend its cut of 1 million bpd until the end of August, with Saudi Energy Minister Prince Abdulaziz bin Salman commenting on the country’s solidarity with Russia and saying it would do “whatever is necessary” to support the oil market.

While OPEC and OPEC+ nations’ cuts are an attempt at pushing crude oil prices up, increased production from the U.S. has counteracted this. The EIA forecasts 2023 U.S. production to be 12.6 million bpd, surpassing the high in 2019 of 12.3 million bpd.

Energy Shift

Visualizing Copper Production by Country in 2023

Chile and Peru account for one-third of the world’s copper output.

Visualizing Copper Production by Country in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Copper is considered an essential metal for the clean energy transition because it is a great conductor of electricity.

As a result, governments around the world have been encouraging the construction of new mines, and mining companies have been seeking new projects and acquiring existing mines to meet the growing demand.

In this graphic, we illustrate global copper production in 2023, based on data from the U.S. Geological Survey, Mineral Commodity Summaries, as of January 2024.

Most Copper Comes from South America

Chile and Peru account for one-third of the world’s copper output.

| Country | Region | 2023E Production (Million tonnes) |

|---|---|---|

| 🇨🇱 Chile | South America | 5.0 |

| 🇵🇪 Peru | South America | 2.6 |

| 🇨🇩 Congo (Kinshasa) | Africa | 2.5 |

| 🇨🇳 China | Asia | 1.7 |

| 🇺🇸 United States | North America | 1.1 |

| 🇷🇺 Russia | Europe/Asia | 0.9 |

| 🇦🇺 Australia | Oceania | 0.8 |

| 🇮🇩 Indonesia | Asia | 0.8 |

| 🇿🇲 Zambia | Africa | 0.8 |

| 🇲🇽 Mexico | North America | 0.7 |

| 🇰🇿 Kazakhstan | Asia | 0.6 |

| 🇨🇦 Canada | North America | 0.5 |

| 🇵🇱 Poland | Europe | 0.4 |

| 🌍 Rest of World | -- | 3.1 |

| World total (rounded) | -- | 21.5 |

Chile is also home to the two largest mines in the world, Escondida and Collahuasi.

Meanwhile, African countries have rapidly increased their production. The Democratic Republic of Congo, for example, transitioned from being a secondary copper producer in the late 1990s to becoming the third-largest producer by 2023.

Part of the growth in copper mining in Africa is attributed to high investment from China. Chinese mining companies represent 8% of Africa’s total output in the mining sector.

Within its territory, China has also seen a 277% growth in copper production over the last three decades.

In the U.S., Arizona is the leading copper-producing state, accounting for approximately 70% of domestic output. Copper is also mined in Michigan, Missouri, Montana, Nevada, New Mexico, and Utah.

Energy Shift

Who’s Building the Most Solar Energy?

China’s solar capacity triples USA, nearly doubles EU.

Who’s Building the Most Solar Energy?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

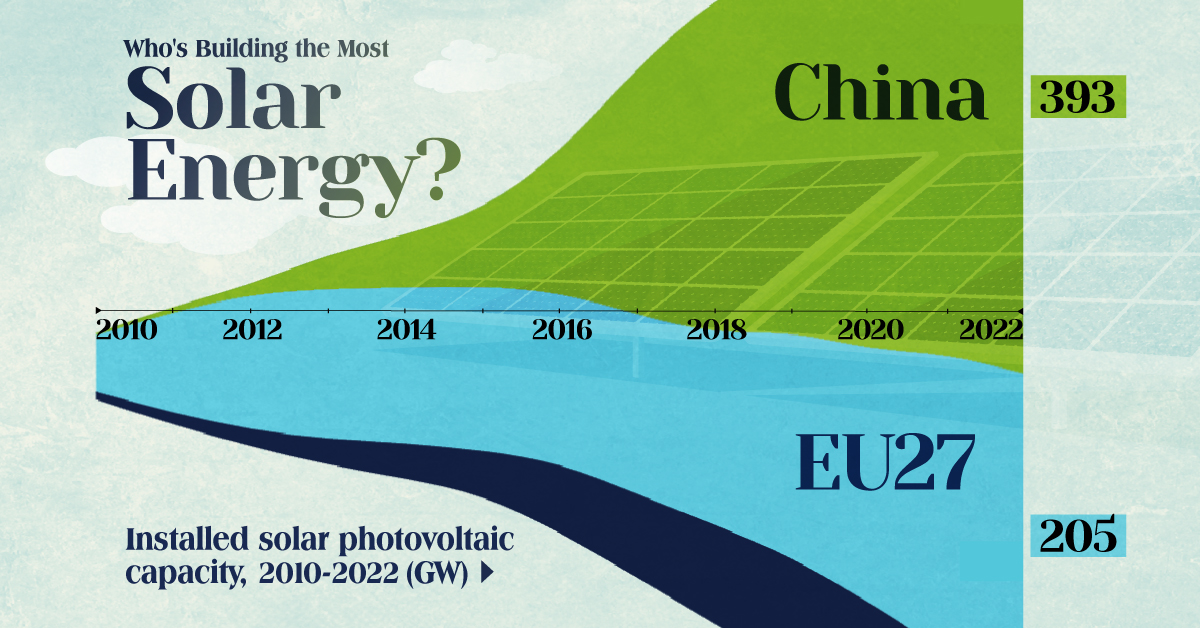

In 2023, solar energy accounted for three-quarters of renewable capacity additions worldwide. Most of this growth occurred in Asia, the EU, and the U.S., continuing a trend observed over the past decade.

In this graphic, we illustrate the rise in installed solar photovoltaic (PV) capacity in China, the EU, and the U.S. between 2010 and 2022, measured in gigawatts (GW). Bruegel compiled the data..

Chinese Dominance

As of 2022, China’s total installed capacity stands at 393 GW, nearly double that of the EU’s 205 GW and surpassing the USA’s total of 113 GW by more than threefold in absolute terms.

| Installed solar capacity (GW) | China | EU27 | U.S. |

|---|---|---|---|

| 2022 | 393.0 | 205.5 | 113.0 |

| 2021 | 307.0 | 162.7 | 95.4 |

| 2020 | 254.0 | 136.9 | 76.4 |

| 2019 | 205.0 | 120.1 | 61.6 |

| 2018 | 175.3 | 104.0 | 52.0 |

| 2017 | 130.8 | 96.2 | 43.8 |

| 2016 | 77.8 | 91.5 | 35.4 |

| 2015 | 43.6 | 87.7 | 24.2 |

| 2014 | 28.4 | 83.6 | 18.1 |

| 2013 | 17.8 | 79.7 | 13.3 |

| 2012 | 6.7 | 71.1 | 8.6 |

| 2011 | 3.1 | 53.3 | 5.6 |

| 2010 | 1.0 | 30.6 | 3.4 |

Since 2017, China has shown a compound annual growth rate (CAGR) of approximately 25% in installed PV capacity, while the USA has seen a CAGR of 21%, and the EU of 16%.

Additionally, China dominates the production of solar power components, currently controlling around 80% of the world’s solar panel supply chain.

In 2022, China’s solar industry employed 2.76 million individuals, with manufacturing roles representing approximately 1.8 million and the remaining 918,000 jobs in construction, installation, and operations and maintenance.

The EU industry employed 648,000 individuals, while the U.S. reached 264,000 jobs.

According to the IEA, China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028.

Despite the phasing out of national subsidies in 2020 and 2021, deployment of solar PV in China is accelerating. The country is expected to reach its national 2030 target for wind and solar PV installations in 2024, six years ahead of schedule.

-

Electrification3 years ago

Electrification3 years agoRanked: The Top 10 EV Battery Manufacturers

-

Electrification2 years ago

Electrification2 years agoThe Key Minerals in an EV Battery

-

Real Assets3 years ago

Real Assets3 years agoThe World’s Top 10 Gold Mining Companies

-

Electrification2 years ago

Electrification2 years agoMapped: Solar Power by Country in 2021

-

Misc3 years ago

Misc3 years agoAll the Metals We Mined in One Visualization

-

Energy Shift2 years ago

Energy Shift2 years agoWhat Are the Five Major Types of Renewable Energy?

-

Electrification2 years ago

Electrification2 years agoThe World’s Largest Nickel Mining Companies

-

Misc3 years ago

Misc3 years agoThe Largest Copper Mines in the World by Capacity